simple – profitable – sustainable

To be an investor you must be a believer in a better tomorrow

(Quote from Benjamin Graham, Warren Buffett’s teacher)

Green Energy investment with positive impact – The real Green Bonds

- Individual or standard solution by preference – Scalable and splittable

- Diversification with low correlation to traditional „financial assets“

- Inelastic demand for basic supply – predictable revenue cash flows

- Ideally a diversified portfolio of direct and indirect investments

mainly in the public area of infrastructure – Inflation protection - Preferably in industrialised countries with investment grade or

safe advanced refinancing techniques like – “Pay-as-you-go”

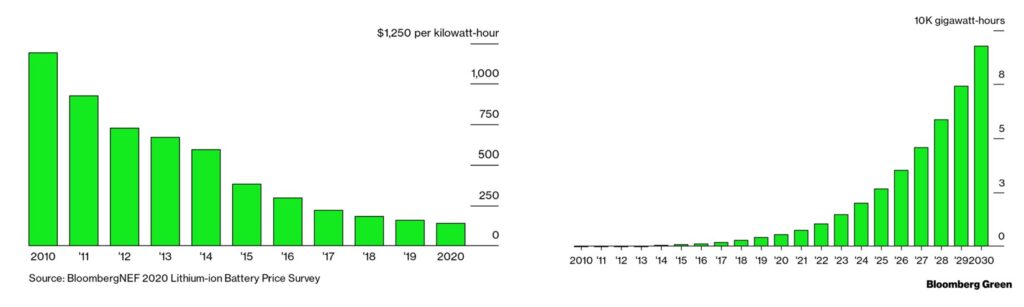

Energy Storage – Prior condition for Green Energy

“The battery has won the race” (Power day 2021, Deiss, VW)

- The more the metal component Nickel, the higher the energy storage resp. density of batteries for E-vehicles, -devices wind- or solar parks

- Smaller, lighter, better (re-) charging, more distances, less costs

- World’s biggest battery factory at Germany in construction by TESLA

- “Battery Day 2020”, Tesla confirms Nickel as preferred choice

- Supported by “EU Battery Innovation” program (January 2021)

- 6 battery factories planned by VOLKSWAGEN in Europe (March 2021).

- MERCEDES EQS (summer 2021) up to 770 km range with battery in a 8:1:1-ratio active material made of nickel, cobalt and manganese.

Battery Metals and “White cement” as strategic commodities – “Green Gold” – Prior condition for Green Energy

- As white fine clay traditional applications:

- Paper, rubber, (Wall-)colours, cosmetics, pharmaceuticals, etc.

- As metakaolin through calcination (burning process) from kaolin:

- Porcelain (ceramics), “White cement” with up to 40% CO₂-reduction, better bending, compressive strengh, refinement, less penetrability.

- As aluminium oxide processed from kaolin with high purity and quality:

- Ceramic high-performance material for heat protection, brakes, etc.

- Synthetic sapphire glass for smart phones, screens, watches, etc.

- Electrically isolating seperators between anode and cathode in lithium-ion batteries for improved performance, life cycle, safety, quality and reliability in E-cars, laptops, etc.

- World’s biggest Nickel reserves and by 2030 production of more than estimated 25% globally. (Rankings Australia 2019)

- 2nd biggest Cobalt reserves (after Congo), 3rd largest production.

- 2nd biggest Lithium reserves (after Chile). World’s largest production.

- 3rd biggest Silver reserves (after Peru, Poland), 4th in production.

- World’s biggest Gold reserves and 2rd largest production (after China).

- Stable returns with long-term power purchase agreements (PPA’s/VPPA’s)

- Reduction of volatility in a traditional investment portfolio

- Optimal contract conditions with reporting – No “Green washing”

- At excellent solar zones, lendable objects for investments

- 1 MW – 1200 MW Sizes available – Splittable for investors

- Global average wind produced ~17% more energy in 2017 than in 2010. Wind speeds predicted 37% more by 2024 (Source Princeton University).

- With around half a million wind power plants worldwide, the technology is well matured and scalable.

- Wind power plants produce the most electricity during the winter months. An ideal seasonal diversification of solar plants.

- About 99% of the land area for wind parks can continue to be used as for agriculture or solar plants (hybrid plants)

t22.

Solar Park Portfolios – “Income” or “Growth” as Investment – Worldwide with Investment grade

More Information (KYC, NDA)

(min. 1 MW, with financemodel)

Solar Parks with hydrogen technology future

Overproduction of electricity from solar plants can be used to split water into oxygen and hydrogen. This recovered hydrogen with a multiple density than gasoline goes then in mobile fuel cells from trucks, buses, cars, trains, ships, buildings or electrical devices to convert back to electricity (practical form of reverse electrolysis). With this hydrogen technology as ideal clean energy storage buffer in the alternative value chain, power grids can be sustainably relieved.

The so-called “solar paint”, with 3 already existing innovative basic types, but so far inefficient, expensive and not scalable, could then be in the future complementable for end users anywhere.

See also “Why Apple and Google are going solar plants” (BBC TV).

Solar Roofs Switzerland, Europe, Americas – With Insurances and Top-quality modules – CO₂-Certificates

The production of Solar and Wind energy are expected to increase by the factor 60 resp. 13 from 2015 to 2050. A Global Grid Parity as an enormous potential turning point can be reached towards around 2030.

And there is already existing in more than 30 countries a local Grid Parity (Source: McKinsey, Our Insights, Global Energy Perspective 2019).

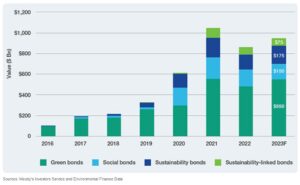

Even with a relatively small investment, the investment requirement for green bonds can be diversified individually according to different asset classes, regions, access routes and project pipeline – energy supply, water and sewage systems, communication, transport and traffic, education or health.

This can results in various long-term above-average return opportunities for the investor as possible as passive income.

Wind Park Portfolios – “INCOME” OR “GROWTH” as Investment – Worldwide with Investment grade

Seasonal diversification (Hybrid PPA’s/VPPA’s)

More Information (KYC, NDA)

(min. 1 MW, with financemodel)

t21.

Clean Tech investment – 2nd Gen. Biofuel from used cooking oil – Circular economy with recycling waste to energy

The growing importance of renewable energy in alternative investments like green bonds demands a competence in this infrastructure area. For example solar plants in the desert of Morocco, solar plants in China (BBC TV) or algae plantations in the sea, as long-term third-generation biofuel, could support energy needs and reduce CO₂ in the coming future (study „Negative carbon via ocean afforestation“, Uni Florida, 2012).

On a short-term converting environmental problem of waste to renewable energy (WTE) like to invest in recycling used cooking oil for biofuel, has an enormous potential in Clean Tech – especially at low public infrastructure. An average reduction up to 90% in global warming gas CO₂ was determined for biofuel made from waste fats (study RFS2, EPA, 2010).

Basically with vetegable biofuel from used cooking oil (change process of transesterification), diesel engines are able to run without modifications. As various trucks, buses, ships or generators in daily use simple switchable.

This kind of vegetable biofuel can have very advanced lubrication level unlike traditional fossil fuel. Thus better engine performance, extending engine life, reducing costs and sustainable less dirty emissions.

More Information (KYC, NDA)