Sustainable Investing with Alternative Values – More in uncertain times

Topic Overview – In countries with investment grade (CHF, USD, EUR)

REAL ESTATE – FOOD TECH

- Off Market Real Estate, Sell or buy of income properties Ø 3.5% p.a.

- Vertical Farming Operational, high demand, less CO₂, up to 15% p.a.

Indoor halls in various countries, more yield with 24/7/365-growth.

(Video Brother Kimbel of Elon Musk; Why Food is the new internet?)

GREEN ENERGY – CLEAN TECH

- 2nd. Gen. Biofuel Operational, high demand, scaling, up to 7% p.a.

WasteToEnergy-Refineries in various countries, up to 90% less CO₂ - Off Market Solar-, Wind-Parks, Sell or buy (no storages) Ø 3.5% p.a.

Further Alternatives – LEGAL TECH

- Battery storages and commodities, Fine Wines, White cement (less CO₂)

- Legal Finance with insurance combined, quarterly pay-outs, 5-10% p.a.

(Reference Plaintiff is the priority ATE-manager DAS Canada, MunichRE

Video What is Litigation Finance Duncan Law Firm Texas at Salt Forum)

Indoor halls in various countries, more yield with 24/7/365-growth.

(Video Brother Kimbel of Elon Musk; Why Food is the new internet?)

GREEN ENERGY – CLEAN TECH

WasteToEnergy-Refineries in various countries, up to 90% less CO₂

(Reference Plaintiff is the priority ATE-manager DAS Canada, MunichRE

Video What is Litigation Finance Duncan Law Firm Texas at Salt Forum)

More information (KYC, NDA)

Alternative Investments – „LAST REFUGE FOR INCOME“ – Building robust diversified portfolios with stability

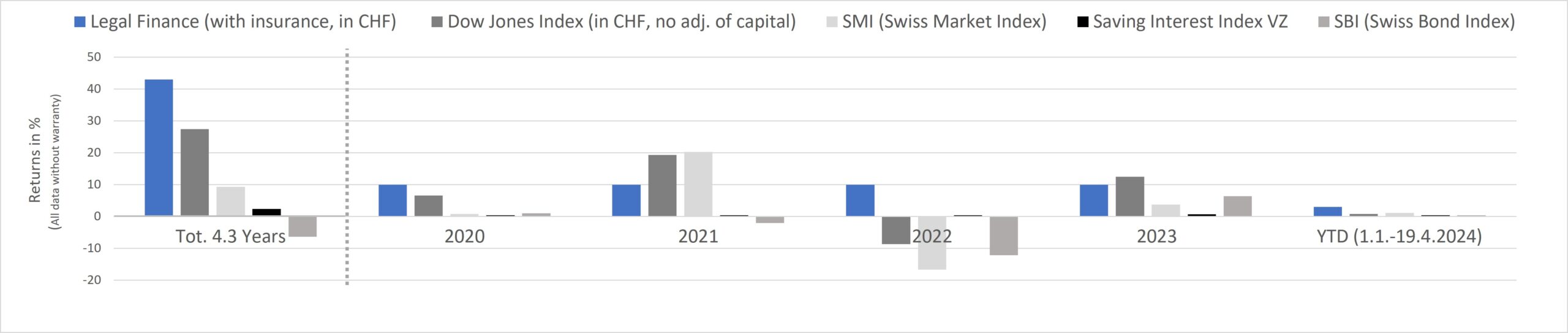

Example: Legal Finance (TPLF) with insurance combined (To enlarge you can click directly on the following graph with your mouse)

Graphic Table (Track Record) © Copyright SwissFinanceSteuber 2024

TPLF is an arrangement where an outside party finances some or all of a plaintiff’s legal costs in return for a share of the proceeds from the case resolution

(Source Swiss Re, Zurich, Switzerland, Litigation Finance is expected to play an increasingly important role, Trend Spotlight publication)

The fast and complex globalisation demands for different approaches to defend your portfolio against volatility and instability. The zero interest rate policy did cost hundreds of billions for depositors and pensioners. Low interest rates can threaten pension funds and insurances. About 1 of 4 EU-citizens dependon a pension income. With inflation the pressure will increase. Alternative investments as real sustainable investing are necessary.

In the corona and economic crisis many countries, especially such with weak infrastructure, high corruption and low income budget, have been set back by years, some even decades, even more indebted with increasing dependencies from abroad, and digitization continue being advanced even further. Will there be after the corona crisis before the corona crisis or is there another “forced deglobalization” needed? The risk report 2021 (January 19, 2021) from WEF Switzerland says clearly: “More other dangerous and infectious diseases to be likely”.

Will there be for possible deglobalized solutions after an energy transition also a financial transition or will the digitalization rollout make perfect the globalization?

Positive Impact with real sustainable Investing – From niche product to financial future

—————-–

Because of increasingly volatile financial investments like traditional stock markets with their continuing up and down movements, meanwhile just real alternative investments are the fastest growing investment form. Did your banking advisor show you which diversification grade and risks he applied for the result of returns?

The pension funds in Switzerland do gain by far not anymore their target returns. Furthermore inefficient allocation of your capital for too low coupons can prevent successful projects. A lot of pension funds abroad enlarge intentionally the asset class alternative investments selectively and diversified. The trend in real values will continue. The proportion of alternative investments in the portfolios for example of pension funds in Switzerland has increased continuously since the turn of the millennium. But not everything called real alternative investments must also be complex. Interesting opportunities are above listed real assets. Thus with alternative investments as real sustainable investing or impact investing the possibilities are for diversification almost unlimited.

Sustainable Investing for Infrastructure – The real Green Bonds – Portfolios with Green- and Brownfieldmix

——————–>–

Diversification is an established tenet of conservative investment

(Quote from Benjamin Graham, Warren Buffett’s teacher)

Traditional diversification of investments by preferences as like:

- Industry, stage of value chain

- Currencies, duration, countries, region

- Project or in operation, growth or value

- Variable dividends or fixed coupons

Alternative diversification by real sustainable 17 UN SDG’s as like:

- Good health and well-being (3), Clean water (6) and energy (7)

- Industry, innovation and infrastructure (9)

- Cities, communities (11), consumption, production (12)

- Climate action (13)

Traditional diversification of investments by preferences as like:

- Industry, stage of value chain

- Currencies, duration, countries, region

- Project or in operation, growth or value

- Variable dividends or fixed coupons

Alternative diversification by real sustainable 17 UN SDG’s as like:

- Good health and well-being (3), Clean water (6) and energy (7)

- Industry, innovation and infrastructure (9)

- Cities, communities (11), consumption, production (12)

- Climate action (13)