Off Market Real Estate for more diversified portfolios – Advanced Vertical Farming operational outside Switzerland

Price is what you pay. Value is what you get.

(Quote from Benjamin Graham, Warren Buffett’s teacher)

t24.

Vertical Farming in commercial urban real estate – Food Security with “Triple L” – Complement to traditional Farming

————————————————->

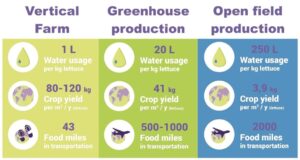

——————————————————————————————————————————————————————————> (Source eitfood.eu)

Smart monitoring of climate control in the green houses with cloud computing

of light, CO₂, water and nutrition with higher crop yields (fruits and vegetables):

- Up to 15x vertical inhouse layers possible (traditional 1 land area)

- Up to 10x economical LED light 8760 hrs/y. (traditional ~900 hrs/y.)

- Against heat, drought, hail and frost – Up to 100x higher crop yields

- Up to 99% less water consumption, pesticides, fertilizer and waste

- Up to 99% less transport – Supply Security with “Triple L”

More Information (KYC, NDA)

Imagine anywhere in a Vertical Farming house by backed-up historical data simulating the best herbs vintage of Toscana – It became real now.

Videos Brother Kimbel of Elon Musk in Vertical Farming (NBC), Why food is the new internet? (TED), Father of Vertical Farming; Prof. D. Despommier (Colombia UNI, NY).

Off Market Real Estate

- More stable returns with long-term rental agreements

- Leverage with relative moderate Swiss mortgages

- Discretion and more exclusive: tailor-made Off-/on-market

- Option: Due dilligence and valuation processing (DCF)

- Core, Core Plus, Value Add or Opportunistic with optimal

contract conditions for buyer and seller

Income Properties

- Residential real estate as multifamily, co living, micro living, retirement home

- Logistic centers (distribution after online shopping), shopping event centers, commerce or industry area centers, office towers

- 4-5 star holiday beach hotels or business city hotels from 100 rooms

- Attractive plot of land with direct beach from 100 m and from 20’000 m²

- Marinas as inventory object, for expansion or new construction possible

- Commercial real estate – Switzerland, Germany, Europe or USA

- At business hotspots with excellent infrastructure and logistics

- At preferred locations. Distance to the airport maximum 90 minutes

- Hotel real estate or land with permission in South Europe at Mediterranean coast, the Caribbean, Florida, South-East Asia near known tourist centers

- At holiday hotspots with outdoor activities such as water sports

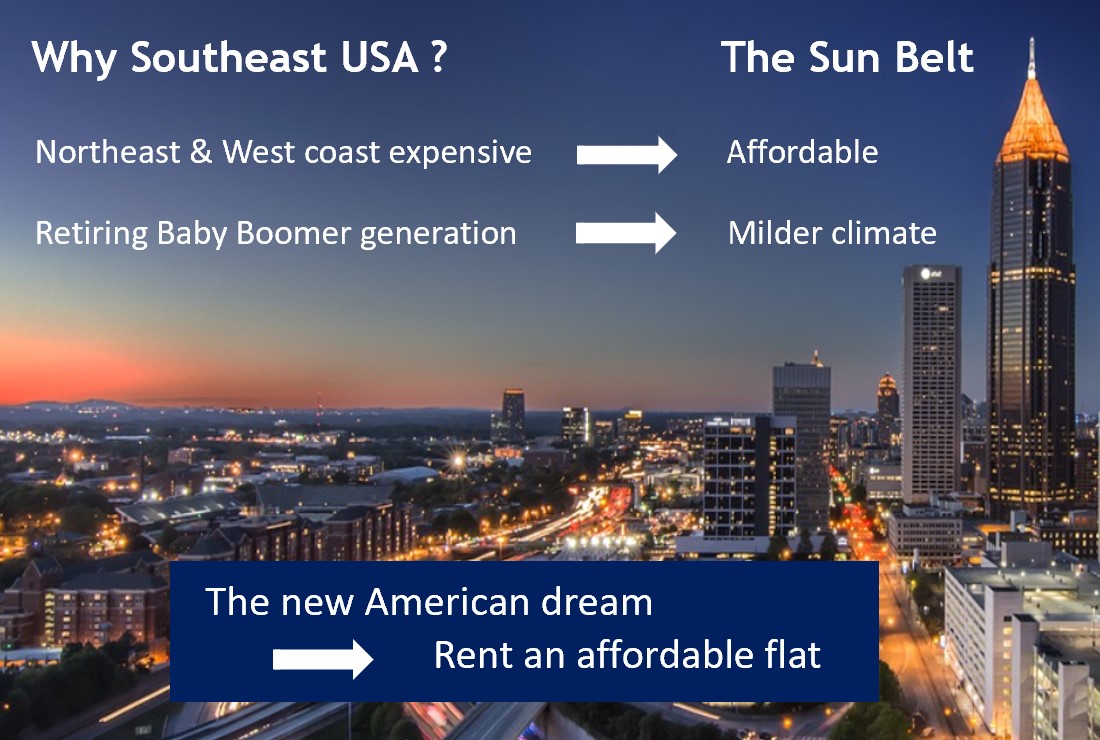

Off Market Real Estate – Multi Family Houses USA

Region “Techlanta” (Atlanta – State Georgia – Sun Belt): ∅ 75 – 300 simple flats per village with Value Add model:

- Google and Facebook have opened large centers. Facebook investing

1 Billion US$ to add 3 data centers. Amazon almost doubled its size. - GE, NCR, Honeywell moved their digital innovation center to Atlanta.

- Black Rock opened innovation hub in Atlanta, Thyssenkrupp by 2021.

- Largest urban redevelopment project of USA converting unused railway to 22 mile transit loop, 28 mile cross-town transit lines and 33 miles of multi-use trails connecting 45 neighborhoods – “Atlanta Beltline”.

Off Market Real Estate – Switzerland (Midland), Europe (Germany, Spain, UK), Caribbean (Bahamas)

Switzerland

- Various Multifamily residences (MFH’s) with 4-90 flats available, solid tenants, no luxury, hist. return ∅ 3-4% p.a. (unleveraged), 1-40 mio CHF.

Region Zurich, Aargau, Bern, Solothurn, Baselland, Geneva, Tessin, etc. - Various Building Land (with projects). Logistic-, Shopping Centers, Hotels.

West Europe

- 3-5 Star Hotels (Mallorca, Ibiza, Valencia, Murcia, etc.) 2-125 mio €.

- New Co-Living residences at trendy locations in a big cities, exp. return unleveraged ∅ 5% p.a., WALT ∅ 15 years with commercial known tenants.