Traditional values – Alternative values

………….

It requires a great deal of boldness and caution to make a great fortune. And when you have got it, it requires ten times as much to keep it.

(Quote from Nathan Mayer Rothschild)

Swiss Family Office – Basic

- Opening Swiss Bank Account – Multi Asset Manager

- In CHF, EURO, USD, AUD, CAD, NZD, GPB, YEN or BRL

- Lower pricing, better conditions, with our Swiss lawyers

- Emigration services to Switzerland:

- Change of residence

- Coaching of children, successor planning, education, schooling, training

- Trusts, foundations, inheritance administration, finance controlling

- “Escrow” services: Guarantee interchange of contractual benefits

- Set-up and organisation of your own individual Family Office

Swiss Family Office – Plus

- Asset Consolidation (with/without software)

- Traditional values like equities and bonds

- Participations, private equity and private debt, private funds

- Income properties, vertical farming, green energy, commodities

- Litigation Funding, oldtimer, art, fine wines, gemstones, gold

- Check-up of Cost Structure of your rates and charges

- Risk Controlling of Asset management – Manager selection

- Financial Modeling with fair valuation and individual reporting

- Advanced Impact Investing with Philanthropy and ROI together

t23.

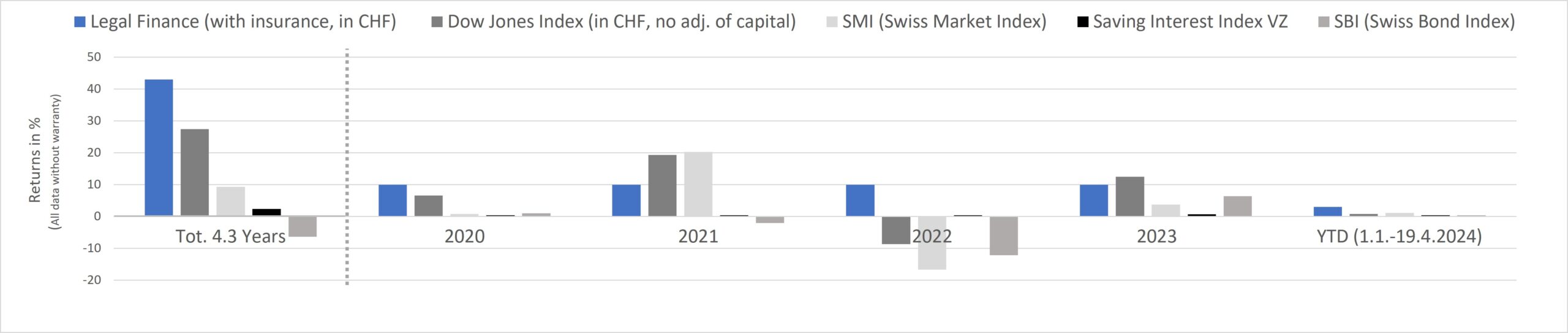

Legal Finance asset class (Third Party Litigation Funding, TPLF) – at us with insurance and in CHF

Graphic Table (Track Record) © Copyright SwissFinanceSteuber 2024

Graphic Table (Track Record) © Copyright SwissFinanceSteuber 2024

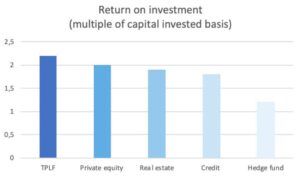

TPLF is an arrangement where an outside party finances some or all of a plaintiff’s legal costs in return for a share of the proceeds from the case resolution

(Source Swiss Re, Zurich, Switzerland, Litigation Finance is expected to play an increasingly important role, Trend Spotlight publication)

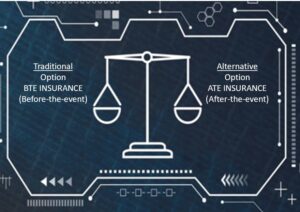

In 1999 with The “Access to Justice” Act in mainly England and Wales the intention was originally to offer alternatives to traditional litigation funding, which had been before just conditionally Legal Aid.

Ch. 22, Para. 3: “This Act replaces the legal aid system with two new schemes; and makes provision about private methods of funding litigation..”

Ch. 22, Para. 32: “The Act reforms the law relating to conditional fees and “after the event” legal expenses insurance..”

Ref: Access to Justice Act, A. Funding of Legal Services (Parts I&II, sections 1-34)

Thus following this huge change in the legal landscape the Litigation Funding industry was born and started to grow continuously to a multi-billion asset class mainly in the Anglo-American markets (UK, USA, Canada, Australia).

–

–Litigation Funding Investment Market to See Huge Growth by 2024

(Quote from usd analytics, Dec. 2023)

Portfolio with thousands of individually reviewed claims from law firms:

- No volatility and no correlation with traditional markets

- Since years returns 5-10% fixed per year, quarterly pay-outs

- Very high diversification, small claim sizes, relative short durations

- Secured (Lloyd’s of London, (Re-)insurance, Fitch+S&P; AA-, Very Strong)

Comp. UBS (Fitch Rating A, Downgraded, S&P Outlook Negative, 7.9.23) - More sustainable inflation protection, saves cash-flow of companies

Reference Litigation Finance Navigator (Bloomberg Law, New York)

Video Mr. Lifely, Partner at Int. Law Firm (Osborne Clarke since 1748, London)

————————————————————————————————————————————————————->(TPLF = Third-Party Litigation Funding, Source Bloomberg, per total duration)

————————————————————————————————————————————————————->(TPLF = Third-Party Litigation Funding, Source Bloomberg, per total duration) Allows lawsuits to be decided on their merits, and not based on which party has deeper pockets or stronger appetite for protracted litigation

(Quote from retired New York Supreme Court Justice Eileen Bransten)

Deal flow of various established Legal Financing types with law firms:

- Manager: Selection, Software (LegalTech), Settlement

- Law firms: Acknowledged, established and proven

- Investor: Yield-oriented Funding (with ESG/SDG-Impact)

- Injured plaintiff: Precondition alternative insurance (ATE)

Ref. Plaintiff is the priority (ATE-Insurance manager DAS Canada, MunichRE)

Video What is Litigation Finance (Duncan Law Firm of Texas at Salt Forum NY)

More information (KYC, NDA)

Real Estate services – Switzerland, West Europe (Germany, Spain, Italy, Greece), USA (Florida, Georgia), Caribbean (Bahamas)

- Preparation of a porfolio of real estate objects at your preferences

- Presentation and showing your selected objects with owner or agent

- Organization of local bank (for Swiss mortgages) on your individual need

- We negotiate better price and local conditions than on your own alone

- Supporting you in local issues for buying your dream object successfully

Business consulting – logistic solutions

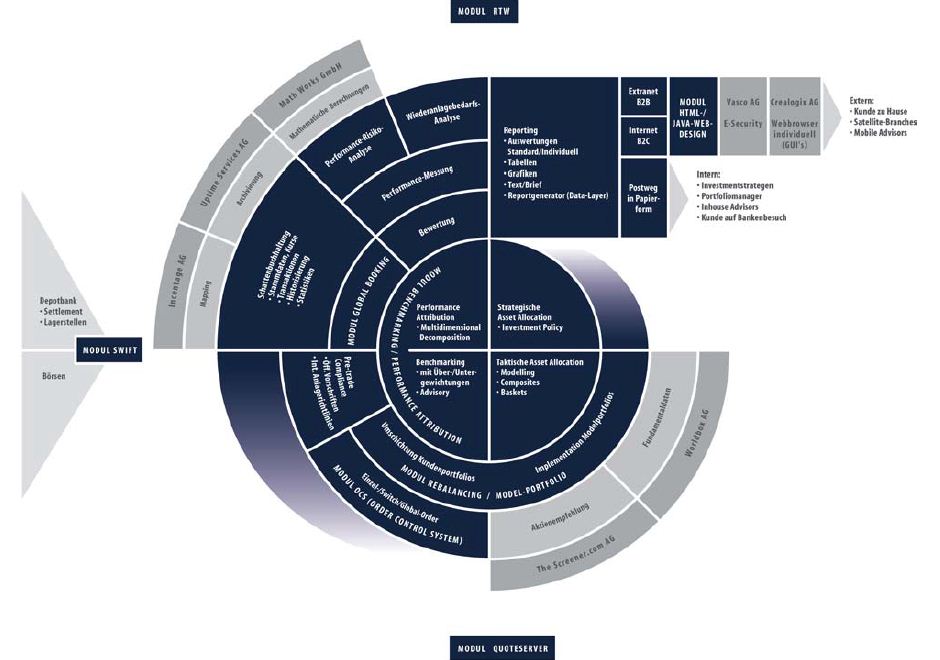

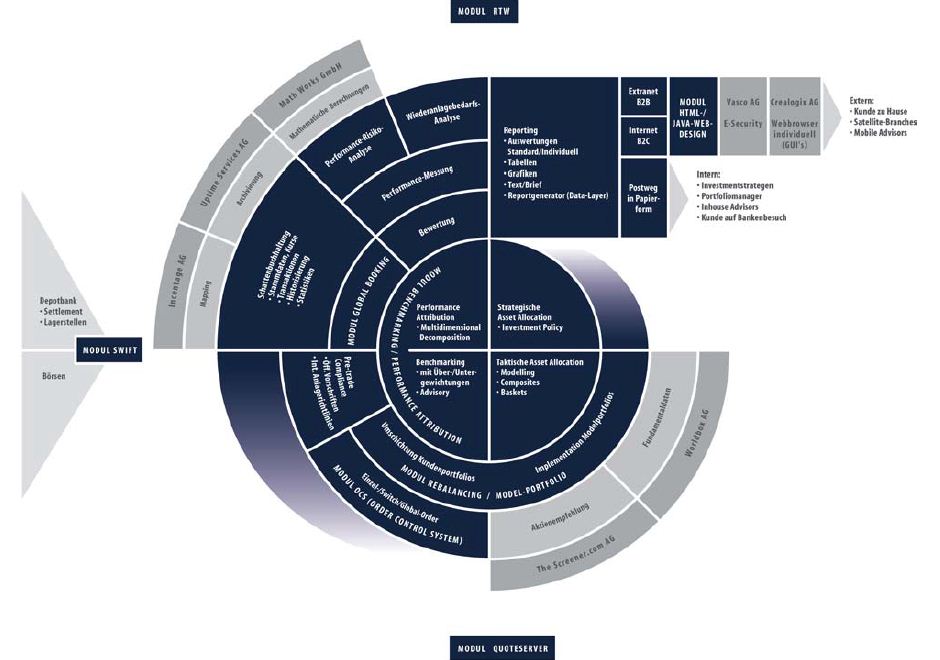

- Evaluation and monitoring of your Asset Management Software:

- Portfolio features: Asset Allocation (BM, Peer Group, CAPM), Monitoring (Compliance), Ordermanagement (STP), Performance-, risc analysis (TWR/MWR, Sharpe, VaR), Reporting (B2B/B2C), …

- Technical features: Systemarchitecture (DB, Data-Warehousing, Apps, Scalability), Middleware (SWIFT, RTW, Mapping), Web Browser (GUI, Hosting), Security (Smartcards, SSL), …

- Operational features: 24/7, Multi currency, Update with Silent mode, Corporate Actions, Valor/ISIN/WKN aggregations, …

- Special reports for accounting (Switzerland) and controlling

Business consulting – market solutions

- Commercial Int. (Working Cap, Corporate Finance) with partners:

- Export- or import-finance, Currency trading

- (Reverse) Factoring of Swiss & German suppliers

- Set-up of business plan & Marketing material:

- Business development for markets

- Competitor analysis of target markets

- Web design & site for marketing projects

Swiss Family Office – with long-term value

A stable legal and social environment as here in Switzerland, is a good pre-condition for a long-term planning of a family office. With one of the world’s lowest debt ratios Switzerland is one of the few countries with an AAA rating. Switzerland is neither a member of the EU nor the euro zone, has it’s own sovereign currency (CHF),

and achieved with a unique actively practiced direct democracy prosperity and security. Moreover, the public infrastructure in Switzerland by world standards is well developed and reliable. After the successfully opening of a Swiss Family Office, there is often a consolidation and valuation of all kind of assets needed. Especially with complex, historically grown investments a global overview and structure becomes more important.

Tailormade solutions according your entrepreneurial needs and current individual living situation – Swiss Finance Steuber – Advantage through know-how. You are worth it.

- Preparation of a porfolio of real estate objects at your preferences

- Presentation and showing your selected objects with owner or agent

- Organization of local bank (for Swiss mortgages) on your individual need

- We negotiate better price and local conditions than on your own alone

- Supporting you in local issues for buying your dream object successfully

Business consulting – logistic solutions

- Evaluation and monitoring of your Asset Management Software:

- Portfolio features: Asset Allocation (BM, Peer Group, CAPM), Monitoring (Compliance), Ordermanagement (STP), Performance-, risc analysis (TWR/MWR, Sharpe, VaR), Reporting (B2B/B2C), …

- Technical features: Systemarchitecture (DB, Data-Warehousing, Apps, Scalability), Middleware (SWIFT, RTW, Mapping), Web Browser (GUI, Hosting), Security (Smartcards, SSL), …

- Operational features: 24/7, Multi currency, Update with Silent mode, Corporate Actions, Valor/ISIN/WKN aggregations, …

- Special reports for accounting (Switzerland) and controlling

Business consulting – market solutions

- Commercial Int. (Working Cap, Corporate Finance) with partners:

- Export- or import-finance, Currency trading

- (Reverse) Factoring of Swiss & German suppliers

- Set-up of business plan & Marketing material:

- Business development for markets

- Competitor analysis of target markets

- Web design & site for marketing projects

Swiss Family Office – with long-term value

A stable legal and social environment as here in Switzerland, is a good pre-condition for a long-term planning of a family office. With one of the world’s lowest debt ratios Switzerland is one of the few countries with an AAA rating. Switzerland is neither a member of the EU nor the euro zone, has it’s own sovereign currency (CHF),

and achieved with a unique actively practiced direct democracy prosperity and security. Moreover, the public infrastructure in Switzerland by world standards is well developed and reliable. After the successfully opening of a Swiss Family Office, there is often a consolidation and valuation of all kind of assets needed. Especially with complex, historically grown investments a global overview and structure becomes more important.